Sr22 Insurance Form Texas

Fast Simple and Secure. SR22 insurance must be maintained for a two-year period within the.

Texas Sr22 Insurance Sr22 Quotes Select Insurance Group

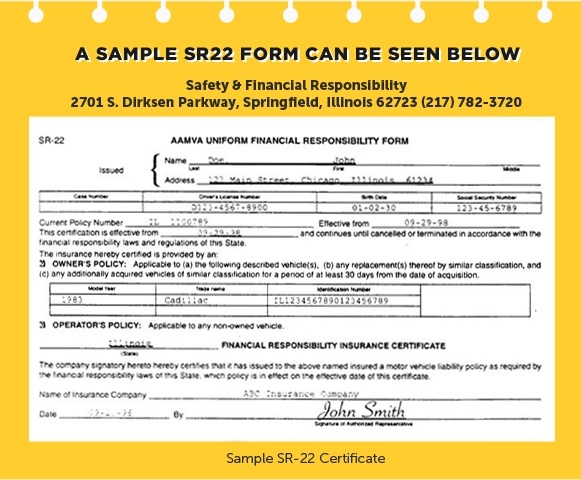

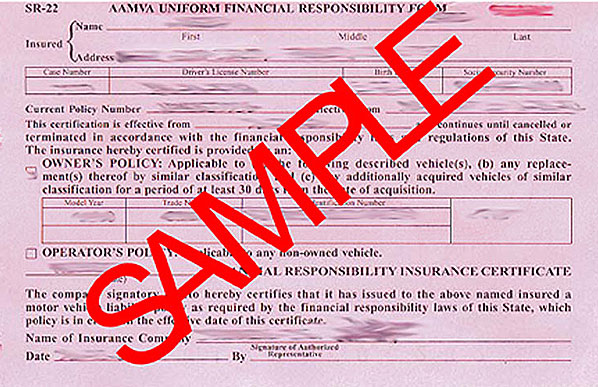

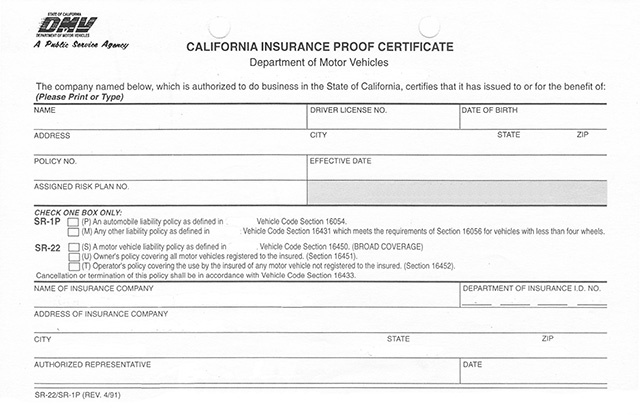

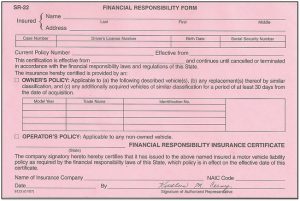

An SR-22 is not an actual type of insurance but a form filed with your state.

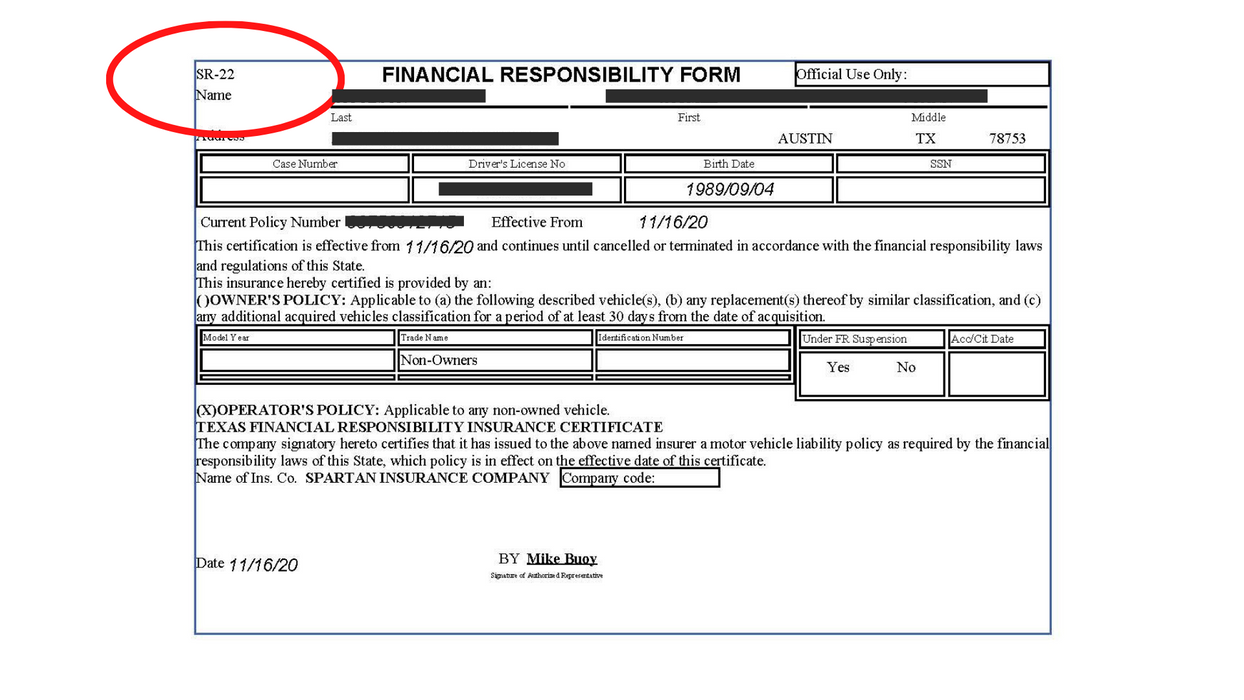

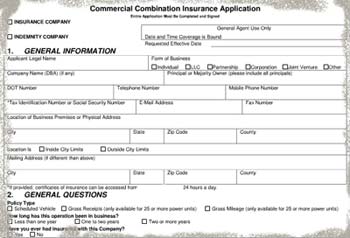

Sr22 insurance form texas. After youve paid all charges visit your insurance company and ask them to submit your SR-22 financial responsibility form. Once youre insured your carrier will electronically file this form for a fee. No the Texas SR22 form is a certificate the insurance company sends electronically to the state.

It is the same as the SR22 form used in other states except that Georgia requires you to pay for your SR22A policy up front which guarantees that you will remain insured for at least 6 months. An SR-22 is a certificate of insurance that shows the Texas Department of Public Safety proof of insurance for the future as required by law. Learn Quote and Buy Texas SR22 Online.

In Texas the average SR22 auto policy is around 2700 which is 64 higher than other drivers in the state. Non owners insurance is a liability only insurance policy designed for drivers who dont own a vehicle but need SR22 insurance. Non Owner SR22 Insurance.

We send your SR22 to the Department of Public Safety instantly. When you file SR22 insurance in Texas the state requires that the minimum liability limits be. A SR-22 can be issued by most insurance providers and certifies that you have the minimum liability insurance as required by law.

The SR-22 form is filed by your car insurance carrier with your states Department of Motor Vehicles DMV. SR-22 rates are often far higher than general insurance and must continue to meet Texas minimum insurance requirements. An SR-22 is a form thats filed with your state to prove that you have car insurance meeting the minimum coverages required by law.

If you allow the SR-22 coverage to lapse your driver license andor driving privilege would be re-suspended and a new SR-22 and a 100 reinstatement fee. At most the SR22 insurance form merely notifies the DMV regarding the credibility of the automobile insurance. Geico Progressive USAA American Family and Safeco are some of the companies that sell car insurance.

Whether youve been charged with a DWI or failure to maintain financial responsibility no insurance the State of Texas requires you to get SR22 insurance. To get your drivers license reinstated you first need to pay a reinstatement fee which is typically around 100 before submitting an SR-22 form to the Texas DPS in Austin. The undertaking of filing a SR22 form is quite affordable and all it requires is 20 US Dollars.

A SR-22 is a certificate filed by your car insurance carrier with the Department demonstrating you have continued automobile insurance coverage as required by the Safety Responsibility Act. If you do not own a vehicle you will need to purchase non-owner SR22A insurance. Certain individuals may need SR22 insurance but dont own a vehicle.

If you dont own a car but need to purchase car insurance in order to either get a drivers license or to have your drivers license reinstated with an SR22 filing and also need SR22 insurance then what you need is a car insurance policy to get back behind the wheels. Texas Form SR22 Insurance is mandatory for a period of two 2 years from the date of conviction. A Financial Responsibility Insurance Certificate SR-22 is required by the Texas Transportation Code Chapter 601 to verify that you are maintaining motor vehicle liability insurance.

In short a Texas SR-22 proof-of-insurance form is required by the State of Texas to reinstate your license when youve had it suspended. For more information regarding the quotes just fill this form and we will be happy to. File with the Texas Department of Public Safety.

SR22 Insurance Texas. Non-Owner SR22 Insurance FAQ. The responsibility in the auto insurance is the actual bargain and in which all your cost is absolutely at.

Your proof of insurance is not sufficient to show financial responsibility if you are required to carry a Texas SR22. Have an insurer file proof of insurance or file. An SR-22 is a certificate of financial responsibility required for some drivers by their state or court order.

Texas SR22 Insurance Requirements. However it is important that you request this form of insurance immediately following an eligible conviction or judgment in order to avoid the suspension of your drivers license and vehicle registration. If you fail to maintain financial responsibility you.

If a suspension occurs you will be notified. Also known as a Certificate of Financial Responsibility SR-22 Bond or SR-22 Form an SR-22 isnt a type of insurance but rather an easy-to-get document from your states department of motor vehicles. If you need to file this form in Texas we represent many top-rated insurance companies who offer same day filing however if you need to file an SR22 in another state as an authorized Progressive SR22 Insurance agent we can file an.

Your insurer may charge a flat fee between 15 and 50 to file the form on your behalf. To get an SR-22 form in Texas youll need to contact an insurance carrier that issues them. This form serves as proof your auto insurance policy meets the minimum liability coverage required by state law.

It is motor vehicle liability insurance that requires the insurance company to certify coverage to. Pay the appropriate SR-22 fee. Texas insurance companies usually charge costs between 15 - 50 to file an SR22.

You will have to carry an SR22 certificate on your auto policy for a minimum of two years. Generally a non owners insurance policy can provide drivers with the cheapest form of SR22 insurance in Texas. Over 40 years of SR22 experience.

Sr22 Insurance Insurance Informations

Sr 22 Insurance Documents And You Honest Policy

Sr 22 Form How To Find The Cheapest Sr22 7 Mo

What Is An Sr22 And How Is It A Part Of A San Diego Dui The Law Offices Of Mark Deniz Aplc

Sr22 Texas Insurance The Cheapest Only 7 Month

The Best Sr22 Insurance Guide Sr22 Car Insurance Cheap Insurance

Traffic Ticket And Estate Planning Law Attorney Texas What Is An Sr 22 When Do You Need One

Sr22 Insurance Cost The Cheapest Sr22 Only 12 Month Free Quotes

What Is An Sr 22 And Why Do I Need One

Sr22 Texas Insurance The Cheapest Only 7 Month

Texas Sr 22 Form Pdf Fill Online Printable Fillable Blank Pdffiller

Texas Sr 22 Form Pdf Fill Online Printable Fillable Blank Pdffiller

Sr22 Texas Insurance Your Trusted Local Texas Agent 512 339 2901

Post a Comment for "Sr22 Insurance Form Texas"