Trade Credit Insurance Meaning

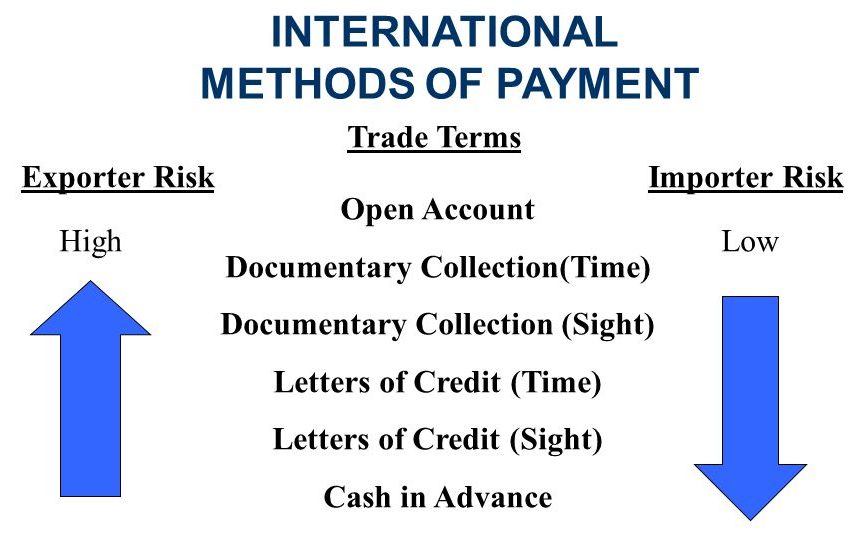

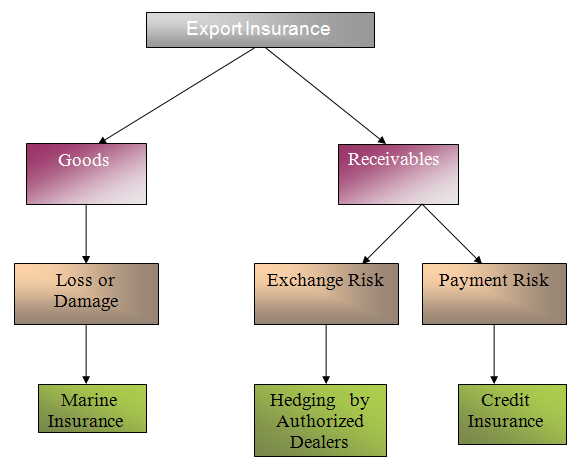

Policies can also cover currency inconvertibility which provides coverage when a client cannot exchange local currency. A trade credit insurance policy allows companies to feel secure in extending more credit to current customers or to pursue new larger customers that would have otherwise seemed too risky.

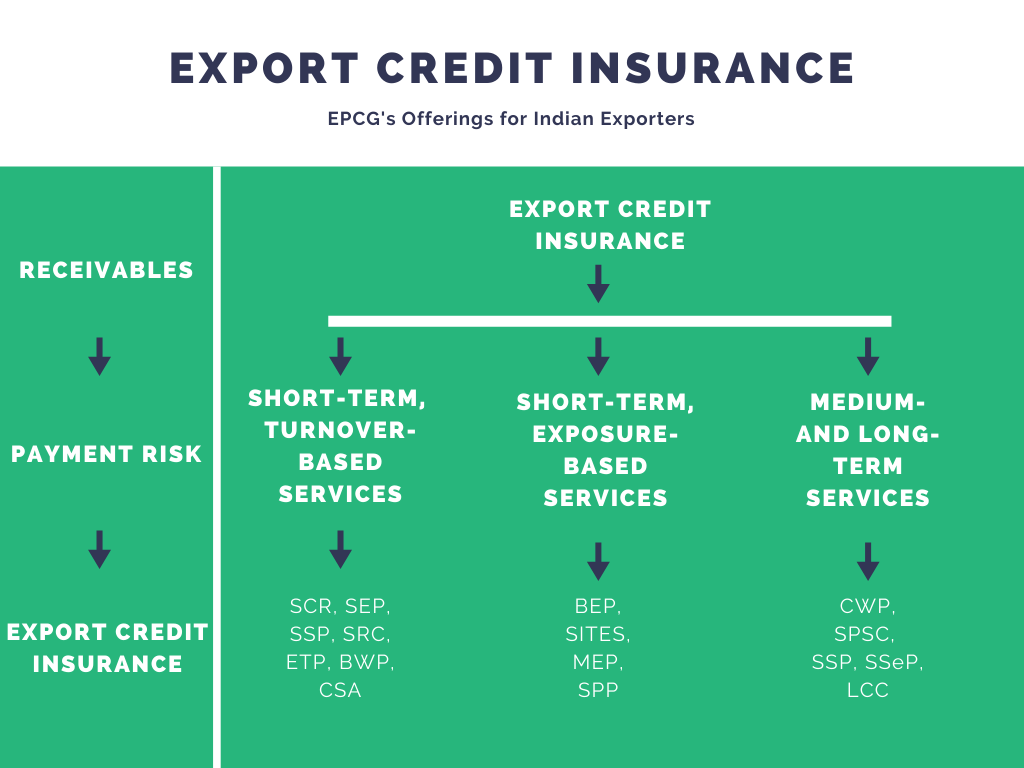

Export Credit Insurance Ecgc S Insurance System In India Drip Capital

Trade Credit Insurance also called credit insurance or export credit insurance protects businesses against financial losses from nonpayment of goods or services by their buyers.

Trade credit insurance meaning. Consequently manufacturers can obtain reliable and up-to-date information on the creditworthiness of their customers significantly boosting the chance of avoiding the mistake of agreeing a large order with a customer that is currently struggling with cash flow difficulties. Trade credit insurance sometimes known as business credit insurance export credit insurance or simply credit insurance protects businesses against the risk of their customers being unable to pay for goods or services they have already received. Transferring risk away from the business and over to an insurer credit insurance protects the policyholder in the event of a customer becoming insolvent or failing to pay its trade credit debts.

What is trade credit insurance. If a buyer does not pay often due to protracted default bankruptcy or insolvency Trade Credit Insurance can cover some or all of the losses. The protection it provides allows a company to increase sales.

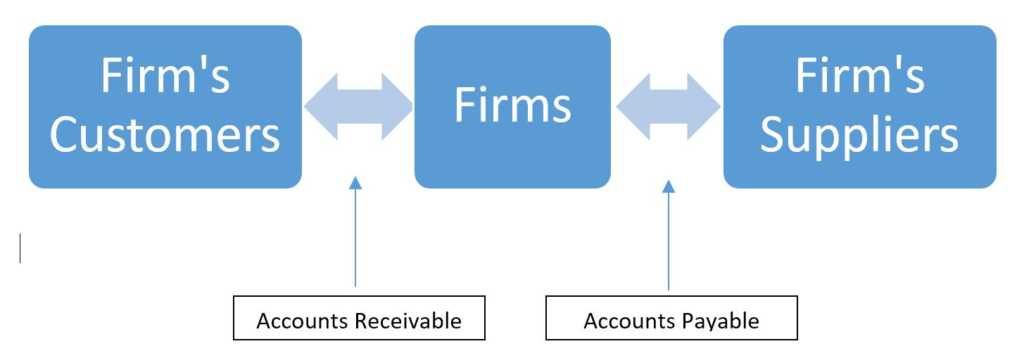

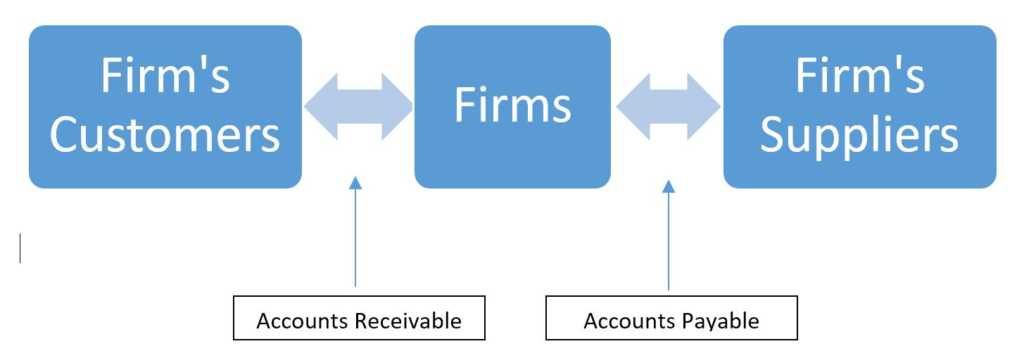

DCL is the acronym for Discretionary Credit Limit most Trade Credit Insurance policies offer this endorsement but sometimes it is not fully understood or appreciated. Trade Credit Insurance or Accounts Receivable Insurance is a form of risk management. Trade Credit Insurance provides protection for accounts receivable and one policy can cover several perils covered risks.

Trade Credit Insurance companies monitor the business turnover and financial health of the companies they insure. Weve been serving and protecting businesses from a range of liability issues for more than 30 years. Trade credit insurance provides cover for businesses if customers who owe money for products or services do not pay their debts or pay them later than the payment terms dictate.

Niche Trade Credit is one of the most professional dynamic and trustworthy Specialist Credit Insurance Brokerages in Australia. It gives businesses the confidence to extend credit to new customers and improves access to funding often at more competitive rates. With credit insurance solutions designed for SMEs Large Companies and Global Businesses we have a credit protection solution to suit all sizes and types of enterprises.

This contract insurance policy assumes a guaranteed promise that the insured will be compensated by the credit insurance company in the case of a covered loss better known as a. Request a FREE Quote. Contact us today and see why business owners trust us with their insurance needs.

It is a two-party contract between the insured and the insurance company. TRADE CREDIT INSURANCE meaning - TRADE CREDIT. Instead American creditors choose to self-insure meaning they employ credit teams to manage risk and place a bad debt reserve on their balance sheets to account for losses in a specific period.

Give us a call today 02 9416 0670. Here is an FAQ to address some of your questions. What does TRADE CREDIT INSURANCE mean.

Trade credit is a type of commercial financing in which a customer is allowed to purchase goods or services and pay the supplier at a later scheduled date. Trade credit can be a good way for. The trade credit insurance industry publication Insurance Business Magazine noted that only 5 percent of American creditors purchase trade credit insurance.

Not only this but insurers can actually help to reduce the risk of financial loss through credit management support. These perils include nonpayment of insured buyer such as bankruptcy insolvency and protracted default.

6 Types Of Payment Terms For Exporters Projectmaterials

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types Examples

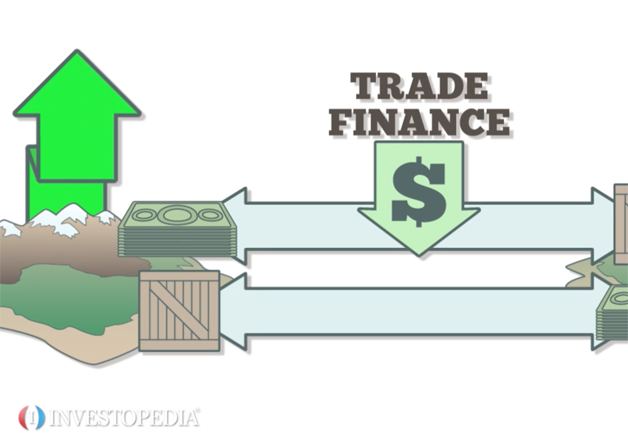

What Is Trade Finance Methods Types Explained In Detail Drip Capital

Edc Credit Insurance Export Development Canada

What Is Trade Credit The Way Trade Credits Work Examples

Coface Trade Credit Insurance In United Arab Emirates Saudi Arabia Bahrain Oman Kuwait Gcc

6 Types Of Payment Terms For Exporters Projectmaterials

Incoterms And Their Impact On International Trade Finance Velotrade Blog

5 Types Of Trade Finance That Facilitate Global Trade

Pdf A Guide To Trade Credit Insurance Full Audiobook Trade Credit Insurance Guided Writing Books

Trade Credit Qbe European Operations

Role Of Ecgc In Credit Insurance

What Is Trade Credit Insurance

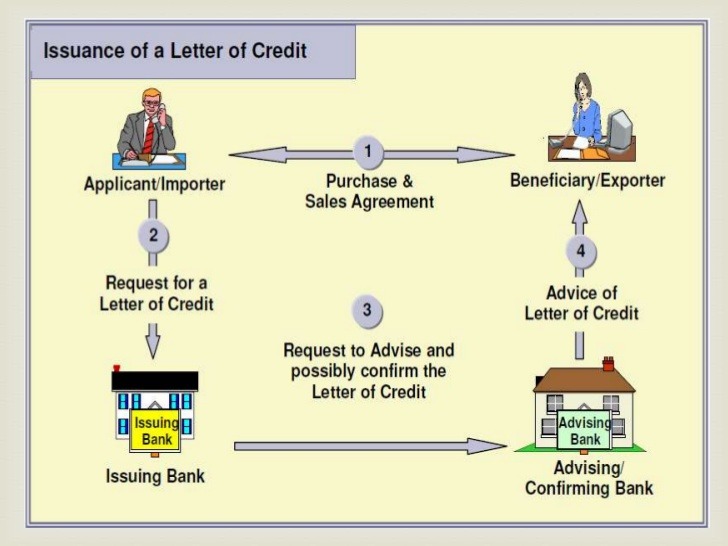

What Is A Letter Of Credit How It Works And Who Needs It

Https Www Mayerbrown Com Media Files Perspectives Events Publications 2019 05 Export Credit Agencies And Political Risk Insurers In Internatinal Project Financing V5 Pdf

Post a Comment for "Trade Credit Insurance Meaning"