Trade Credit Insurance Cost In India

BUYER means a customer or any person who is liable to pay Policy-holder for a trade credit insurance transaction on open and agreed. This policy provides coverage to companies for outstanding receivables that are within approved credit terms thereby protecting the Insured against non-payment risk by its buyers.

Enjoy Enhanced Ncb With Hdfc Ergo Health Insurance Buy Health Insurance Health Insurance Companies Health Care Insurance

A list of biggest trade credit insurance companies by countries.

Trade credit insurance cost in india. The trade or business credit insurance policy is also known as the credit insurance policy. Trade credit insurance means insurance of suppliers against the risk of non-payment of goods or services by their buyers who may be situated in the same country as the supplier domestic risk or a buyer situated in another country export risk against non-payment as a result of insolvency of the buyer or non-payment after an agreed number of months after due-date protracted default or. A list of the largest and best trade credit insurance companies in the World.

This improves funding access at competitive rates. Trade Credit Insurance shall be treated as part of the Miscellaneous Insurance as defined under section 13B of the Insurance Act 1938. However for the purpose of segmental reporting the IRDA Preparation of financial statements and Auditors report Regulations Trade Credit Insurance shall be shown as a separate segment.

Political risk can be covered for buyers outside India. Today Atradius India has more than 32 staff and 14 underwriters. Between small companies with an annual turnover of less than USD 5 million and larger companies with a turnover above this threshold.

Atradius India has supported business across the subcontinent with trade credit insurance since 2001. Coface is awarded Best Provider of Trade Credit Insurance in Asia by CFO Innovation Asia exclusively for top-level finance managers in the corporate sector in Asia and China. Trade credit insurance policy has been especially designed to shield your business from the credit which is beyond your control.

What Is Trade Credit Insurance Policy In India. To get insured the holders of the policy should have a credit limit on each of the buyers. Lets go through some of the general guidelines related to the claims process or settlement in India.

Trade credit insurance means insurance of suppliers against the risk of non-payment of goods or services by their buyers against non-payment as a result of insolvency. For Credit insurance the rate of premium is kept low. This risk is covered under credit insurance plans.

Irdai also insurer should have internal risk management guidelines to assess trade credit risk on the buyer giving credit limits on the buyer and buyer credit limit review. Credit insurance takes care of the risk of payment of the organizations and not of the individuals. The article focused on the events leading up to the impact insurers reactions between the cancellable and non-cancellable limits markets outlook for new business submissions anticipated renewal actions and potential impacts on various reinsurance schemes.

Trade Credit is a whole Turnover policy for all buyers and is designed to safeguards companies against the failure of non-payment of a commercial trade debt arising from Insolvency andor Protracted default. The currency rates change frequently and if rates become volatile due to some problems the business faces risk. This is an insurance for short term account due within 12 months.

What is Trade credit insurance. However the internal systems and processes may vary for different companies. Both these issues are covered under the following eventualities.

Credit Insurance Claim Process. Maximum insured percentage is 85 under this policy. Ankita Sejpal March 6 2020 June 24 2021.

Coface a worldwide leader in trade credit insurance offers companies around the globe solutions to protect them against the risk of financial default of their clients both on the domestic market and for export. For an example if you are a manufacturer in India and sell goods to your international client on credit basis and the purchaser creates issue for paying the payment then this trade credit insurance policy will. Our Credit Insurance Globalliance Policy is designed for companies that are selling their goods andor services on credit to overseas buyers.

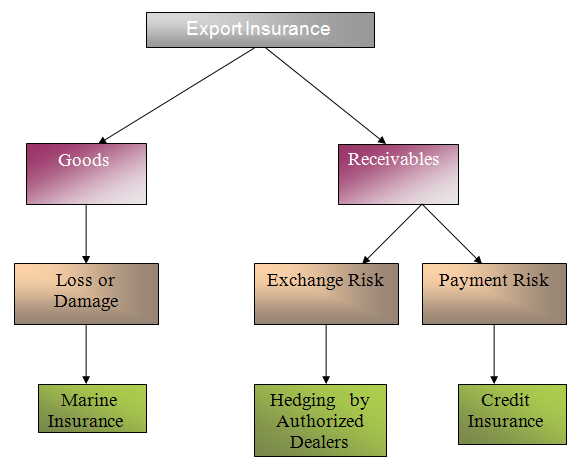

You can also offer credit to new customers. The trade credit insurance policy would cover the risk of non payment due to Insolvency or Protracted Default only and Political Risks can be covered only in case of buyers outside India. Trade Credit Insurance covers risks of both non- payment and delay in payment of debts.

Exim Mitra helps supplementcomplement the information available in other portals on Exports and Imports with focus on Trade Finance and Exports risk mitigation measures such as credit insurance. In addition to documenting the development of the market value from 2009 to 2013 the report also divides it for the most recent year between four key segments. Many national and private insurance companies in India provide credit insurance policy in India.

Know all about Credit Insurance in India. A comprehensive trade credit insurance policy ensures improvement of bottom line quality increase profits and reduce risks of unforeseen customer insolvency. The Bank as the Apex Financial Institution for financing promoting and facilitating Indias International trade consolidates inputs from Banks FIs Insurance Companies and other agencies.

Political risks- If there is loss of payment during exports due to political unrest the same is covered under Trade Credit Insurance. It helps to protect traders service providers and manufacturers against damages from money-making business debt. Political issues covered under this plan are-.

Trade Credit Insurance in India is a report about the market for trade credit cover in India. It combines both Credit Life Insurance and Trade Credit Insurance. In The United American States USA United Kingdom UK Ireland Canada Australia India South Africa Singapore UAE China Japan Germany France Spain Italy and more.

Our Mumbai office was the first to support local Indian insurers to offer trade credit insurance in the Indian market. In May of this year Willis Tower Watson focused our Trade Credit Update based upon the industry impact of the COVID-19 pandemic.

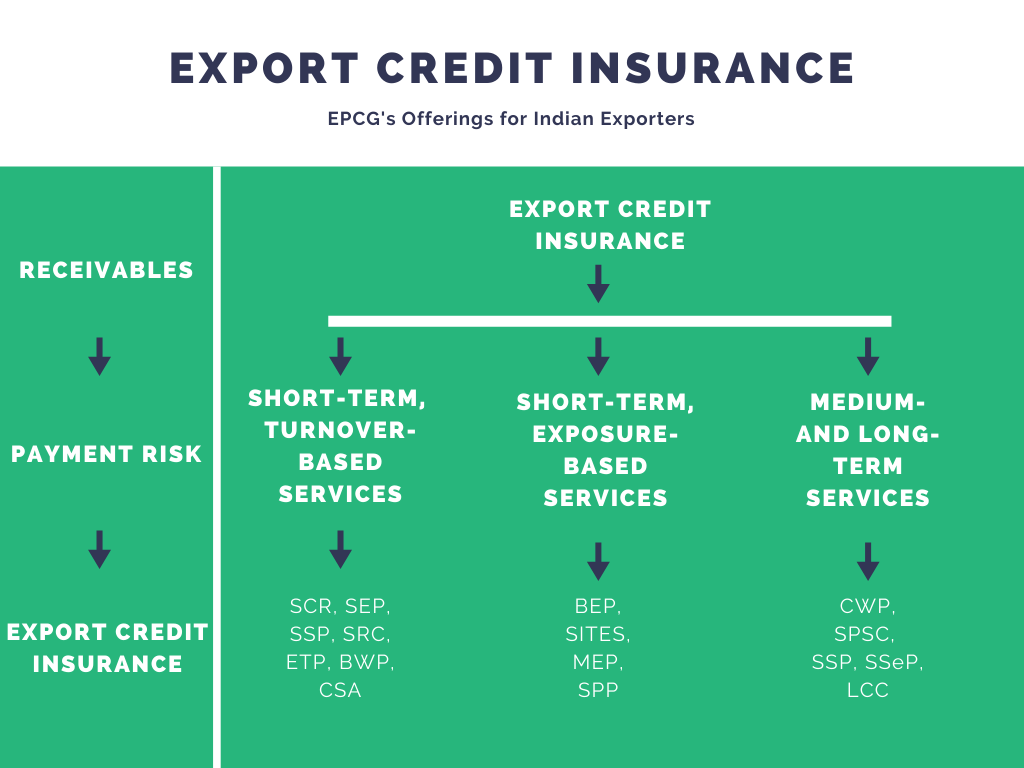

Export Credit Insurance Ecgc S Insurance System In India Drip Capital

Shawn Camp Insurance Agency Inc Offers Flexible And Affordable Insurance Policies For Aut Insurance Industry Life Insurance For Seniors Life Insurance Quotes

Export Credit Insurance Ecgc S Insurance System In India Drip Capital

Invoice Discounting Advantages And Disadvantages The Borrowers Invoicing Advantage

/inventory-2b2cb6fce6ea47fe924717fac0a24b50.jpg)

Trade Credit Insurance Tci Definition

Insure My Sales With Trade Credit Insurance

Tips To Save Money On Car Insurance Policy Infographic Car Insurance Car Insurance Online Car Buying Guide

Coface Credit Insurance Trade Credit Solutions Our Offer Coface

Gst India Insights Learn How The Gst Bill Will Impact Various Sectors In India Automobiles Logistics Fmcg Teleco Bad Debt Debt Protection Insurance Broker

Idbi Bank Auto Loan Rate Of Interest Car Loans Idbi Bank Loan

Complete 2021 Guide On Credit Insurance Coverage Claims Exclusions

Insure My Sales With Trade Credit Insurance

Https Www Jstor Org Stable 24548129

The Best Credit Cards How To Find Them Good Credit Credit Card Best Credit Cards

Insure My Sales With Trade Credit Insurance

Role Of Ecgc In Credit Insurance

Credit Cards Travel Creditcard The Pros And Cons Of Credit Cards In India Rewards Credit Cards Credit Card Help Credit Card Protection

Trade Finance In Times Of Crisis Responses From Export Credit Agencies

Post a Comment for "Trade Credit Insurance Cost In India"