Tail Coverage Insurance Construction

It gives your business protection for claims that are reported after your insurance policy ends. The same goes for lawyers.

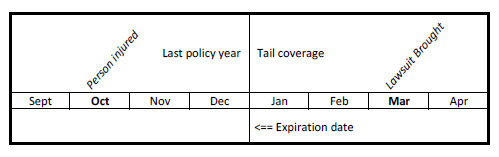

A lawyers exposure for claims arising from work done during a particular policy period extends well past the expiration of the policy period since such a claim may not be made for several years after the work is performed.

Tail coverage insurance construction. This additional insurance policy is to be made primary to the CGL policy. For hospitals each employee is covered under a malpractice policy. McCarthy says lawyers need to understand what claims-made means for them.

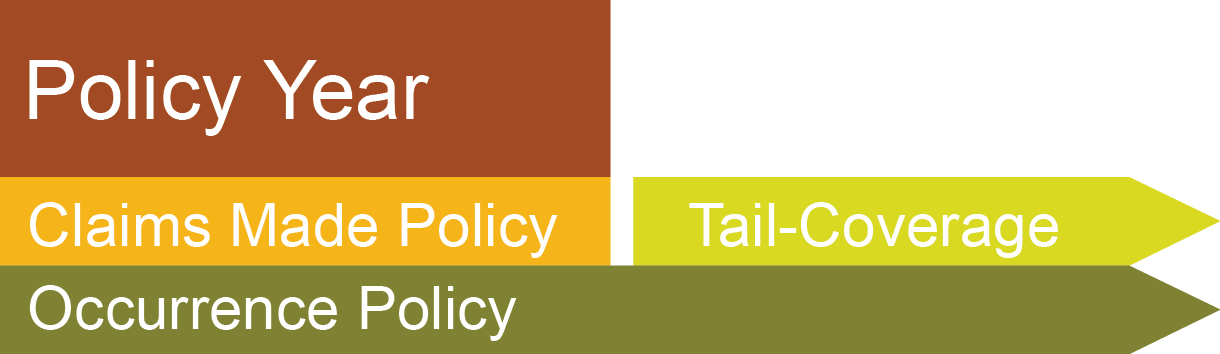

Also referred to as an extended reporting period tail coverage is an additional feature you might buy after canceling an existing policy or letting one lapse. EO Coverage for Construction Construction Professional Liability Insurance can provide coverage for firms in the event of a lawsuit brought against it for claiming negligence in providing or failing to provide your professional services. Tail coverage is a part of how your business insurance coverage works if its written on a claims-made form.

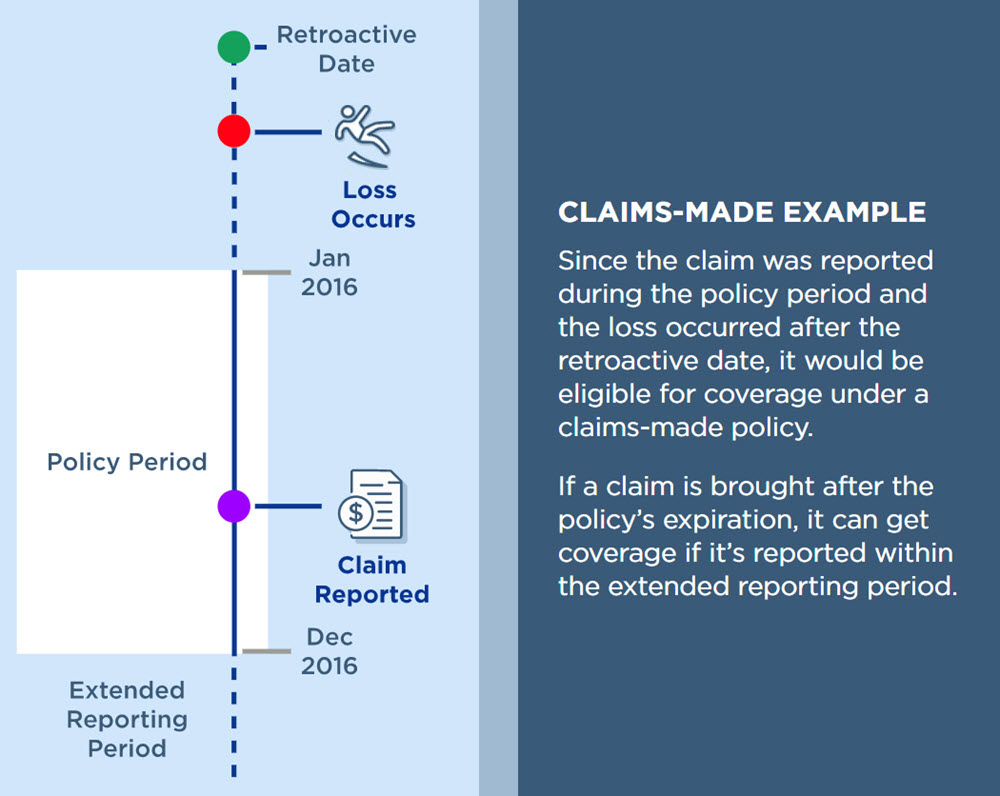

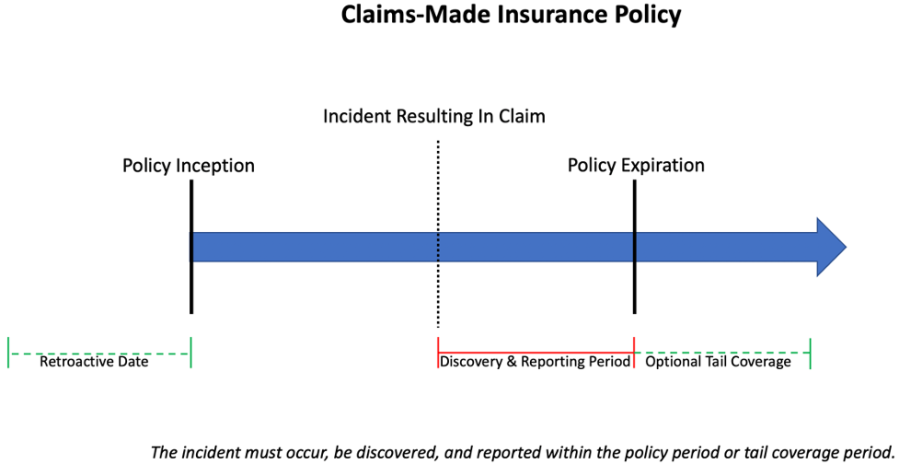

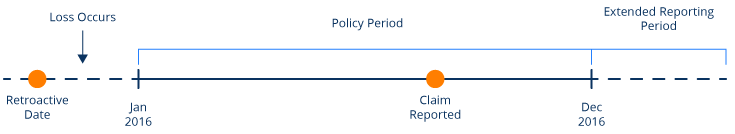

This coverage is also known as an extended reporting period. Additionally the developer must also obtain railroad protective liability and property damage insurance when performing railroad-related services during construction set at 5 million per occurrence and 10 million as a general annual aggregate. According to the International Risk Management Institute IMRI tail coverage insurance is a provision found within a claims-made policy that permits an insured to report claims that are made against the insured after a policy has expired or been canceled if the wrongful act that gave rise to the claim took place during the expiredcanceled policy 1.

Carriers generally issue a bill for tail coverage within two months of a policy cancellation and the cost can run as high as 150. The definition of tail provides a time period in which the insured retains coverage for Errors Omissions claims resulting from professional services that were provided subsequent to the retroactive date listed in the policy and prior to the expiration date. Tail Insurance or Extended Reporting Period ERP coverage is the mechanism that allows future reporting of claims that have not yet been brought to your attention.

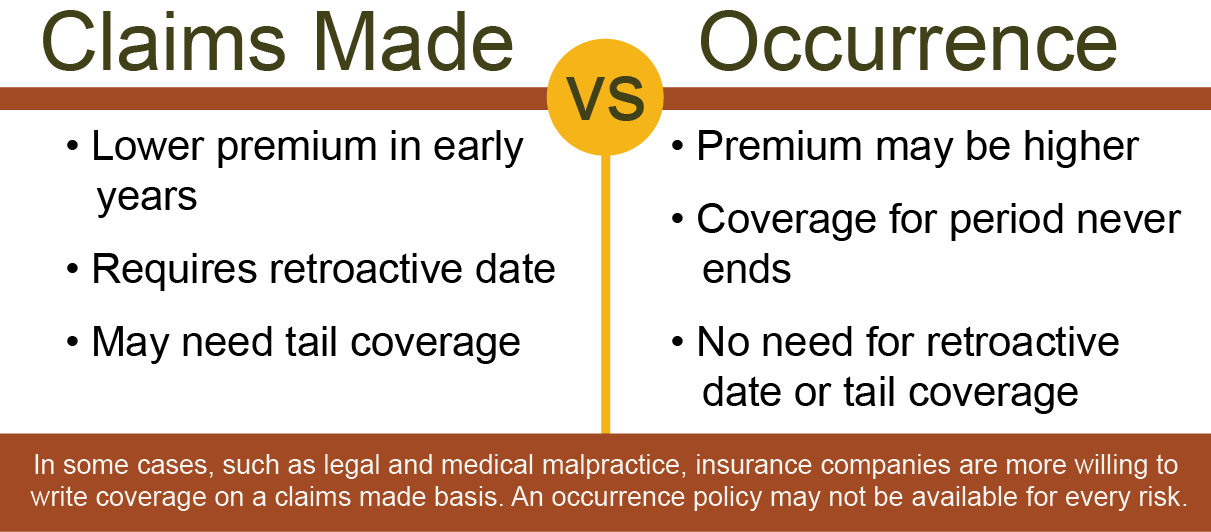

That price can be steep. When a tail policy is purchased the insurance carrier for the selling company agrees to hold open the DO insurance policy for a specified period of time past the policys normal expiration date. Remember when a claims-made policy ends it must be renewed with prior acts coverage or a tail must be purchased.

Unfortunately many firms underestimate the need for coverage and over-estimate the extent that needed. AXIS INSURANCE SERVICES LLC. Before diving more deeply into what tail coverage is and how it works here are a few malpractice insurance basics.

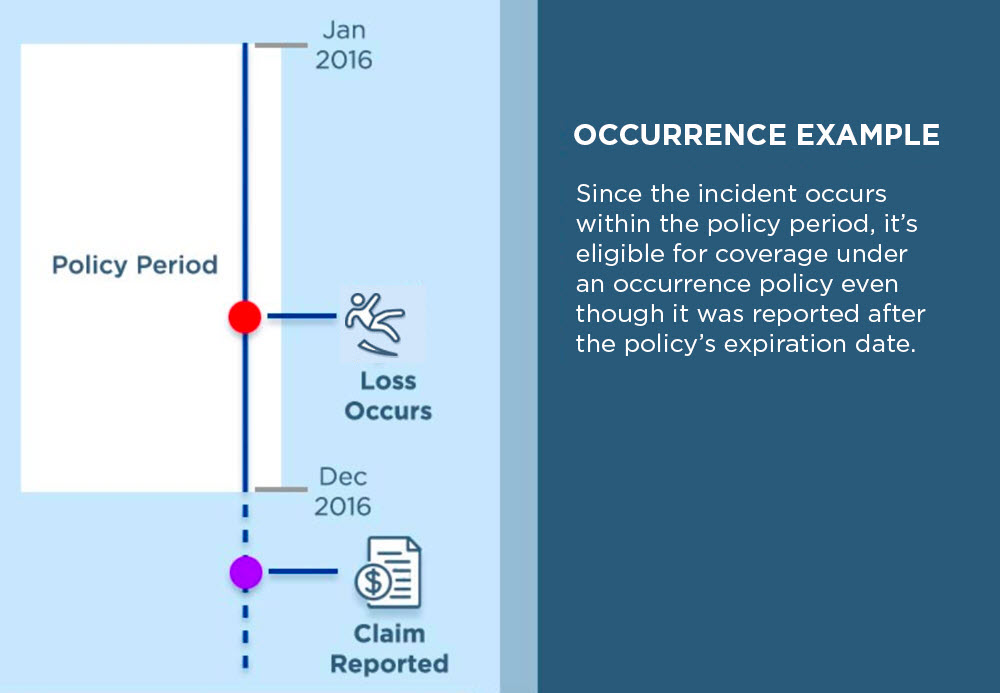

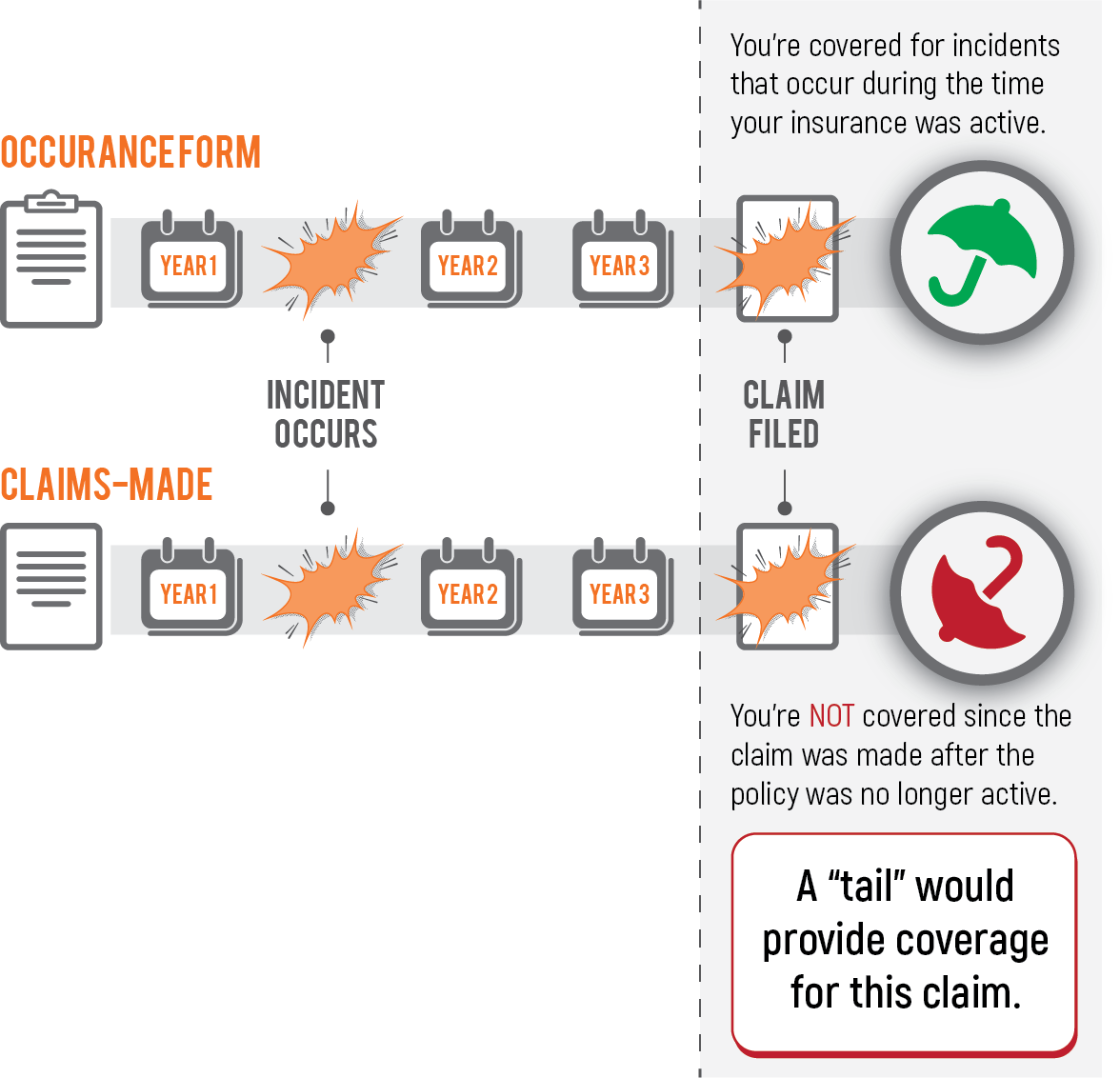

Most insurance policies cover claims made as long as the policy is in place. All professional legal liability. It applies to claims-made insurance policies and typically involves paying your insurer an additional fee.

The tail provides coverage for any claims from services rendered while the policy was in effect. Tail coverage can be quite costly usually 200 to 350 of the cost of your current malpractice premium. Tail coverage requires that the insured pay additional premium.

In the United States six years is the standard. IRMI offers the most exhaustive resource of definitions and other help to insurance professionals found anywhere. Tail coverage is an endorsement or an addition to your insurance that allows you to file a claim against your policy after it expired or was canceled.

Tail Coverage a provision found within a claims-made policy that permits an insured to report claims that are made against the insured after a policy has expired or been canceled if the wrongful act that gave rise to the claim took during the expiredcanceled policy. Because these policies are so costly some insurers have recently began offering policies known as stand alone tail policies. This coverage steps in on covered claims to assist in the companys defense and protects your firm.

Click to go to the 1 insurance dictionary on the web. When Should You Have Tail Coverage Claims-made policies provide coverage for claims brought against a physician resulting from services the physician provided during the time the claims-made policy was continuously in effect. These policies provide less coverage but are also less costly.

With tail coverage youre still insured if a claim is filed against you after the policy ends. New construction and renovation projects can result in a broad range of potential professional liability insurance claims exposures for both the project owner or developer and the contractor and design professionals involved on a project. In other words its the price you pay to convert a claims-made to an occurrence policy.

Tail Insurance Axis Insurance Services For nearly two decades the insurance professionals at Axis Insurance Services LLC have focused on providing custom-tailored insurance solutions for professional services companies and their employees. Malpractice Insurance Coverage Basics. Looking for information on Tail.

Tail coverage insurance is a provision within an insurance policy that allows the insured to make claims after a policy has expired for acts that occurred while the policy was still valid.

Claims Made Vs Occurrence Insurance Claims Made Policy The Hartford

Keeping Up With Clinical Risk Management Who Needs Professional Liability Tail Coverage Parker Smith Feek Business Insurance Employee Benefits Surety

Printable Feature Film Cost Report Template Excel Example In 2021 Rental Agreement Templates Continuity Report Template

Tail Insurance Coverage What Is It Landesblosch

Claims Made Vs Occurrence Insurance Claims Made Policy The Hartford

Claims Made Vs Occurrence Coverage

Didim De Satilik Yazlik Almanin Avantajlari Hasan Huseyin Insaat Home Improvement Loans House Design Cute House

Claims Made Prior Acts And Tail Coverage

Editable Physician Assistant Employment Agreement Terms Of Agreement Physician Assistant Emp Contract Template Physician Assistant Continuing Medical Education

Keeping Up With Clinical Risk Management Who Needs Professional Liability Tail Coverage Parker Smith Feek Business Insurance Employee Benefits Surety

Museum Plein Amsterdam Amsterdam Public Space Travel

Vehicle Inspection Form Template Vehicle Inspection Vehicle Maintenance Log Inspect

Tail Coverage Insurance And Buying Or Selling A Business Kreischer Miller

Pin By Missy Wright On Massage Home Decor Decals Decor Novelty Sign

Post a Comment for "Tail Coverage Insurance Construction"