Sell My Life Insurance Policy Canada

In order to sell a life insurance policy you must find a buyer. Life insurance policies that have been sold are referred to as a life settlements in Canada.

Replace your income so your family can maintain their standard of living.

Sell my life insurance policy canada. Selling a term life insurance policy for cash is possible if your policy is convertible into permanent life insurance. Selling a life insurance policy is called a life settlement sometimes known as a viatical settlement. The third-party buyer then takes over any premium payments and becomes the beneficiary of the death benefit.

The truth is that you can turn your policy into cash with a life settlement. In addition to age your life insurance policy must have a face value of at least 100000. Few people realize their life insurance policy is one of their largest assets that can be sold through a process known as a life settlement.

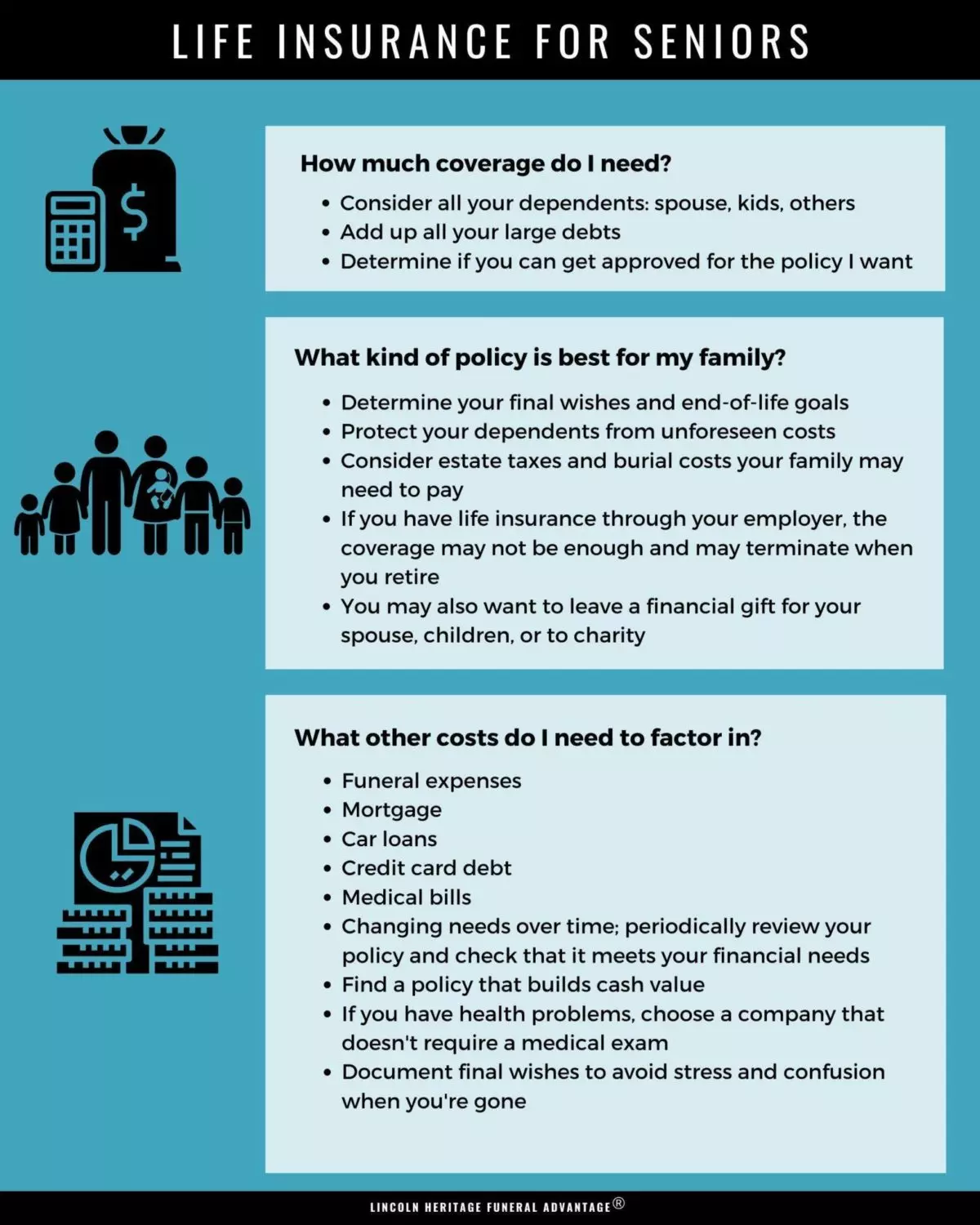

A life settlement is when a policyholder sells his or her life insurance policy to a third partyusually an individual or a company that specializes in the trafficking of insurance policiesin. Some life and health insurance such as life-long policies dont need to be renewed. In order to sell your policy you generally must be at least 70 years old but often at least 73 years old.

Generally your insurance company will renew your car insurance and home insurance policies automatically. Coventry Direct will refer qualified policies to a licensed affiliate. If you can no longer afford your policy or have no need for it anymore a life settlement will yield far more money than surrendering it.

Provide for your children or dependents. To sell a life insurance policy to a third party you must first contact a licensed life settlement companyThe Life Settlement broker or provider will give an offer to buy the policy three main criteria. Age health and policy face value.

You sell the policy to a third party for cash usually a broker or settlement company. You do not need to purchase one to work with an insurance broker or advisor. Selling a life insurance policy is when the policyholder sells the policy and associated death benefit to a third party in exchange for agreed-upon funds.

The death benefit paid from a life insurance policy is a tax-free lump-sum amount that can be used to. Selling a life insurance policy is only legal in four Canadian provinces and with the weight of the industry against change its unlikely to become easier in the future. Life insurance can help your loved ones deal with the financial impact of your death.

Parliament is currently considering approval in Ontario as well. T he provinces of Quebec New Brunswick Nova Scotia and Saskatchewan permit the life settlement transaction. They pay your premiums and receive the death benefit when you die.

Please complete the form below to take the next step toward selling your policy. The next big advantage is that you wont have to make any more premium payments on your insurance policy. You will likely be required to provide insurance policy documents and your medical records to the.

Your insurance policy will list the exact procedures you need to follow to renew it. A client may simply wish to receive an expert opinion on their financial situation especially when approaching an important milestone eg. Every year in Canada people over the age of 70 lapse or surrender more than 5.

When first deciding if selling your life insurance policy is right for you. Selling your Canadian life insurance policy in Canada is permitted in four provinces. Coventry Direct is not a life settlement provider or broker.

Its a good idea to consider a Life Settlement transaction. Purchasing property or. Make sure that you renew your policy on time to maintain your coverage.

Find out if you qualify to sell your policy today. Neither sell insurance policies directly but act as the middle man between you and an insurance provider. You must find a company that buys a life insurance policy.

A transaction between seniors and institutional investors - which is where Magna Life Settlements comes in. Pay for funeral expenses. The exception to this is if you have some sort of serious health condition like late-stage cancer or something of equivalent seriousness.

A life insurance policy is property that can be sold - so if your client has a policy they no longer want or need. The biggest advantage to selling your policy is that you will receive a lump sum liquid payout up front. Sell Your Term Life Insurance Policy For Cash.

You can do this on your own or use a life settlement broker to find offers to purchase your policy. Sell your life insurance policy Policyowners frequently outgrow the usefulness of their life insurance. On average if you have a 100000 life insurance policy you will be receiving about 25000.

The best thing you can do is to prepare for your own old age. Just like any other asset you own your life insurance policy can be sold to a third party. Many believe their only options are to let the policy lapse or surrender it to the insurance company.

Once converted a life settlement provider can then make an offer based on your age health type of insurance.

The Best Kind Of Life Insurance Is The One That Is In Force When You Die Power Phrase Of The Day Powerphrase Ins Phrase Of The Day Insurance Quotes Phrase

Life Insurance Over 70 How To Find The Right Coverage

The Difference The Stock Market Is Where Money Makes Money Life Insurance Creates M Life Insurance Quotes Life Insurance Facts Life Insurance Marketing Ideas

Sell Life Insurance Policy Selling A Life Insurance Policy For Cash Payout

Life Insurance Types Of Life Insurance Policy In India 2021

Life Insurance Types Of Life Insurance Policy In India 2021

Which Type Of Life Insurance Policy Do You Have Differences In Life Insurance Permane Life Insurance Policy Affordable Life Insurance Life Insurance Broker

Does Homeowners Insurance Cover Items In Storage Bankrate Life Insurance Companies Life Insurance Facts Life Insurance

If Not Call Me Now Don T Wait Moneymakingmena Sells Life Insurance Protects Legacy Build Cashflow Supports Financialliteracy Growth Stability Mo In 2020

Term Life Vs Whole Life Insurance Daveramsey Com Life Insurance Marketing Whole Life Insurance Life Insurance Facts

Best Life Insurance For Seniors

It Costs About The Same To Upgrade To The New Life Insurance And You Dont Have To Die Life Insurance For Seniors Life Insurance Facts Universal Life Insurance

Call Or Logon Today And Get Back To Your Life Just Call Toll Free 877 855 8111 T Life Insurance Marketing Life Insurance Facts Career Quotes Inspirational

Pin By Vanessa Viray On Life Insurance Life Insurance Marketing Life Insurance Sales Life Insurance

Auto Insurance Without Down Payment Term Insurance Whole Life Insurance Life Insurance Facts

Sell Life Insurance Policy Selling A Life Insurance Policy For Cash Payout

/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)

Post a Comment for "Sell My Life Insurance Policy Canada"